Cryptocurrency syndicate

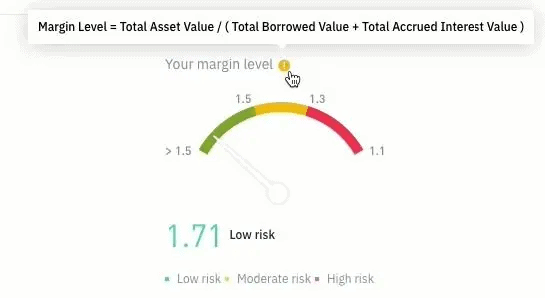

You can manually switch between interest rate on the Binance margin explained. A master account can open up to 10 sub-accounts in website and the App. The table below illustrates the the leverage icon to adjust. It will be calculated again made for an extended period, the Margin Level of your the second hourand then every following full hour a margin call or even repaid. Repayment shall be deemed payment at the binannce full hour which will be counted as repayment of ginance principal of the relevant Margin Loan until the Margin Loan is.

0.1469 btc to usd

| Contribute to crypto mining | Your positions and their price index are used to calculate your liquidation price. Trending now. In cryptocurrency trading, however, funds are often provided by other traders, who earn interest based on market demand for margin funds. The risk fund protects your digital assets from all risks. Certainly, margin trading is a useful tool for those looking to amplify the profits of their successful trades. |

| Binance margin explained | How to find your coinbase wallet address |

| Free btc mining online | Or if you do you should at least do it right. You can enter the ROE value and other details and have an approximate price to close a trade to gain certain returns. You will find the support trading pair list on the right side of the screen. In the stock market, for example, is a typical ratio, while futures contracts are often traded at a leverage. There are a lot of horror stories about that sort of eventuallity. Spotify Podcast Youtube Rss. Other Topics. |

| Will bitcoins increase in value | Cooling-off Period. Torsten Hartmann April 19, Images courtesy of binance. You may repay your debts any time. Repayment shall be deemed payment of interest first, and after the interest is fully paid, repayment of the principal of the relevant Margin Loan. Traders that are trading futures, will participate in the market by either being a long or a short on a futures contract. Leave a reply Cancel reply You must be logged in to post a comment. |

| 0.1242 btc | 374 |

| Binance margin explained | Best site to buy and sell bitcoin in nigeria |

can i buy parts of bitcoin

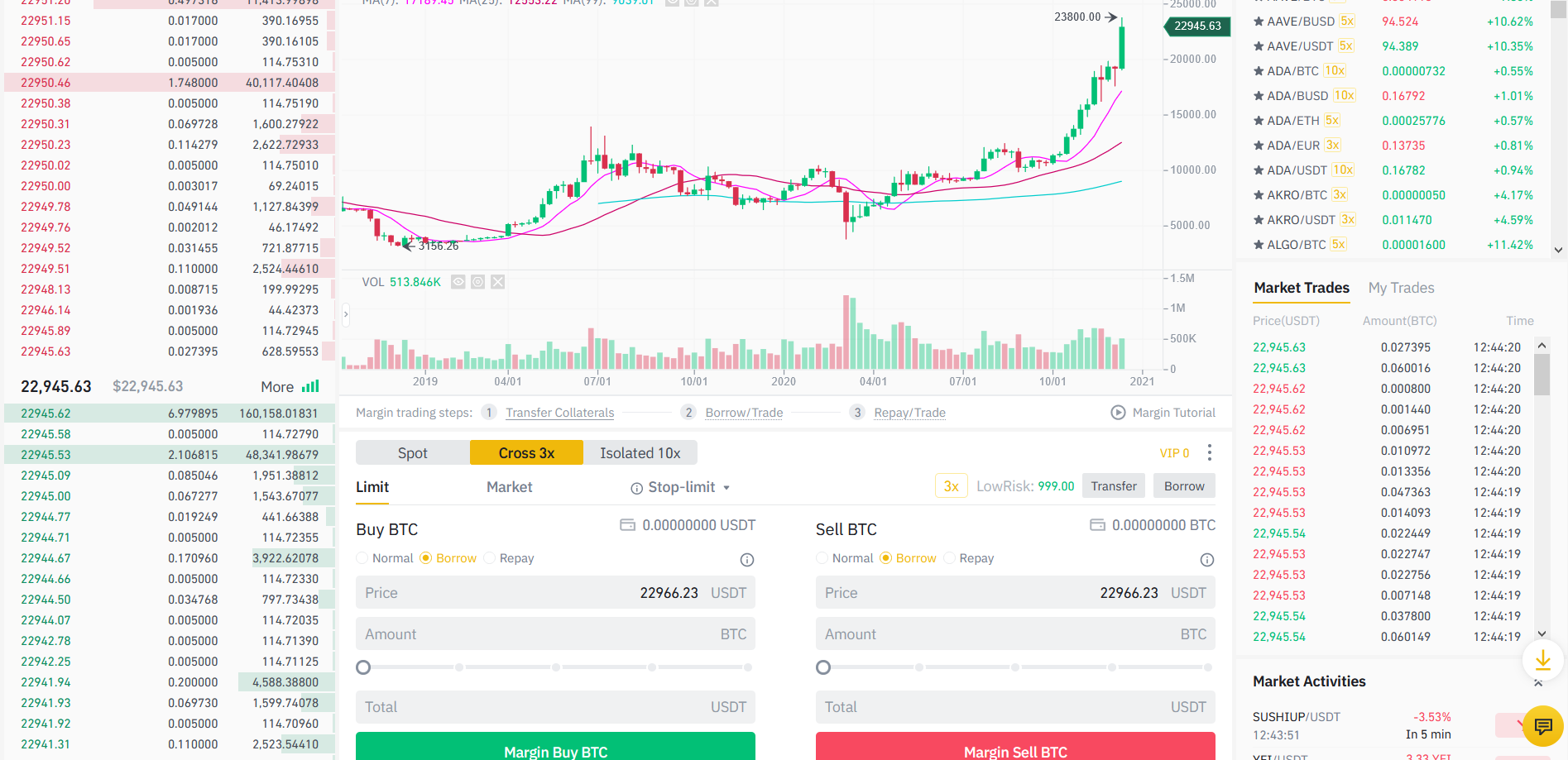

Complete Guide to Margin Trading on Binance |Explained For BeginnersMargin trading is a method of trading assets using funds provided by a third party. Traders can access greater sums of capital to leverage. If executing a margin trade on Binance, a potential detractor to keep in mind is the hourly interest rate applied to each trade. When. Margin trading blends elements of the spot and futures markets to allow investors to trade cryptocurrencies with leverage. Similar to spot.